All-in-One Solution for Lenders

Lender Platform provides all-in-one software solution to cater the requirements of asset finance industry. Allowing users to view real-time data regarding loan information status.

ORION provides all-in-one software solution to cater the requirements of asset finance industry including loan origination, loan assessment, loan settlement, contract management and more. It is compatible with several 3rd party services allowing users to do almost everything from within the software.

Lender Platform is designed to manage 1000’s of users and introducers. 90% of system transactions are completed in less than 10 seconds. It is provided as a service with minimum upfront capital investment and is hosted in Amazon Web Services AWS cloud platform based in Sydney. AWS cloud platform guarantees approximately 99.99% uptime.

The most notable feature of Lender Platform is Customer Portal, which allows status viewing online via customized user-friendly mini-application portal. It allows end-user to track installment deadlines, outstanding loan amount and other loan information with ease through mobile.

Lender Platform is a complete and comprehensive system for assessing loans and financing. It assists in gathering information to assess the applications and makes decision making easier with lots of automated compliance tasks execution. Lender Platform offers various features allowing user to manage loan assessment in an organized way. It has 6 major modules:

System Admin allows the setting up of access levels for users and enables the creation updating and deletion of user and controls the setting of different badges.

View PDF Here

Introducer Portal is where initial information is entered. Lender Platform allows loan application information to be directly entered via Introducer Portal making it easier to record, manage, retrieve, present and analyze data.

View PDF Here

Loan Assessment System assists in determining whether the transaction is to be financed or not. It keeps a track of all required documents and ensures that everything required for issuing loan is in place.

View PDF Here

Settle Management System is the core of Lender Platform where all applications are managed. It helps in managing the settlements of all applications received via Introducer Portal and LAS Systems.

View PDF Here

Contract Management system manages the accounts receivables. It is responsible for handling day to day customer requests such as providing statement of account, provide early termination quote, handle changes in direct debit authority, and more.

View PDF Here

Day End Process manages the month end processing. It allows the interest posting to customer ledger and calculates daily interests.

View PDF Here

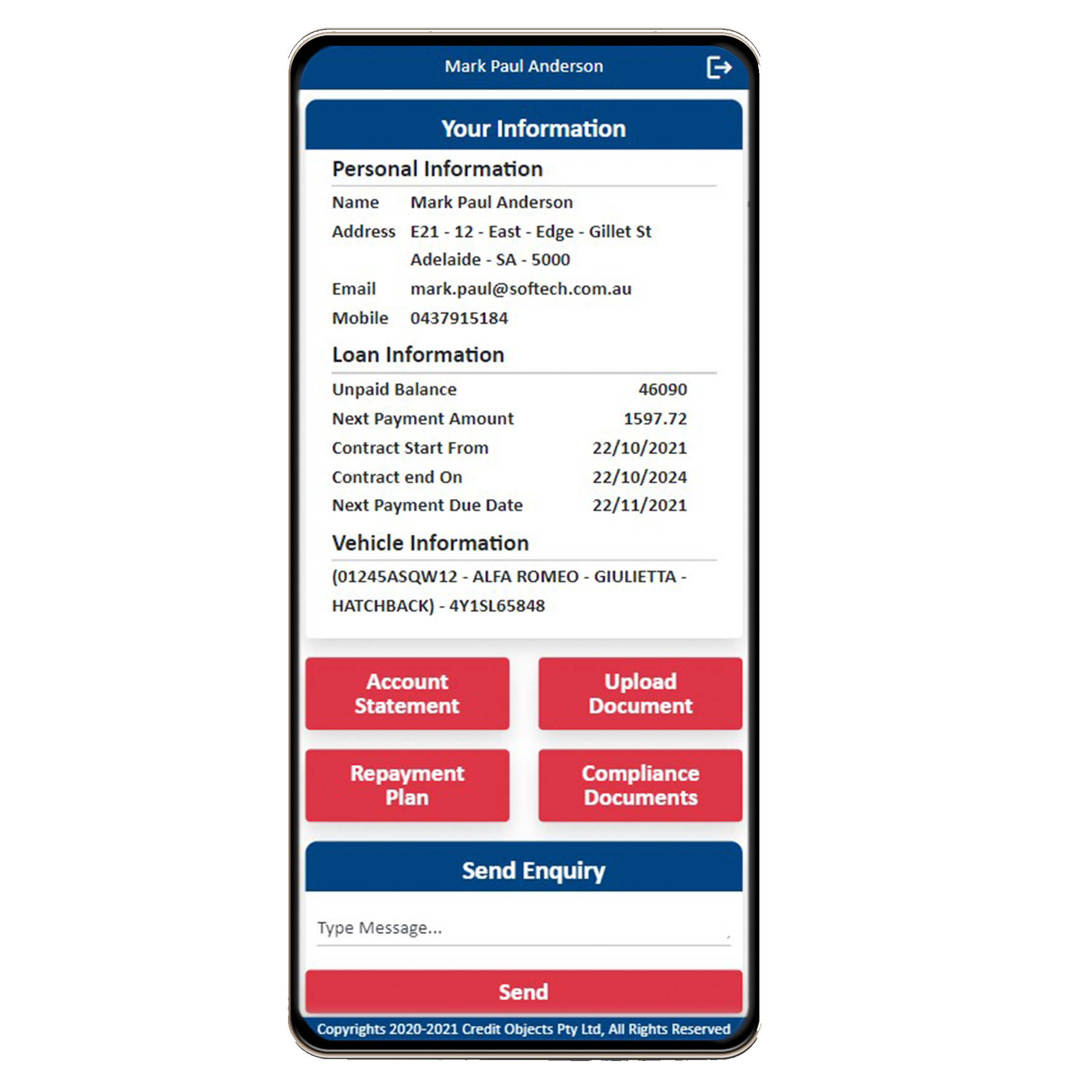

Customer Portal is specifically designed for Customers to track their loan information including unpaid balance, next installment amount and due date, and contract information. If required, customers can submit documents directly via Customer Portal. Customers can also contact the assigned lender via Customer Portal in case of any queries.

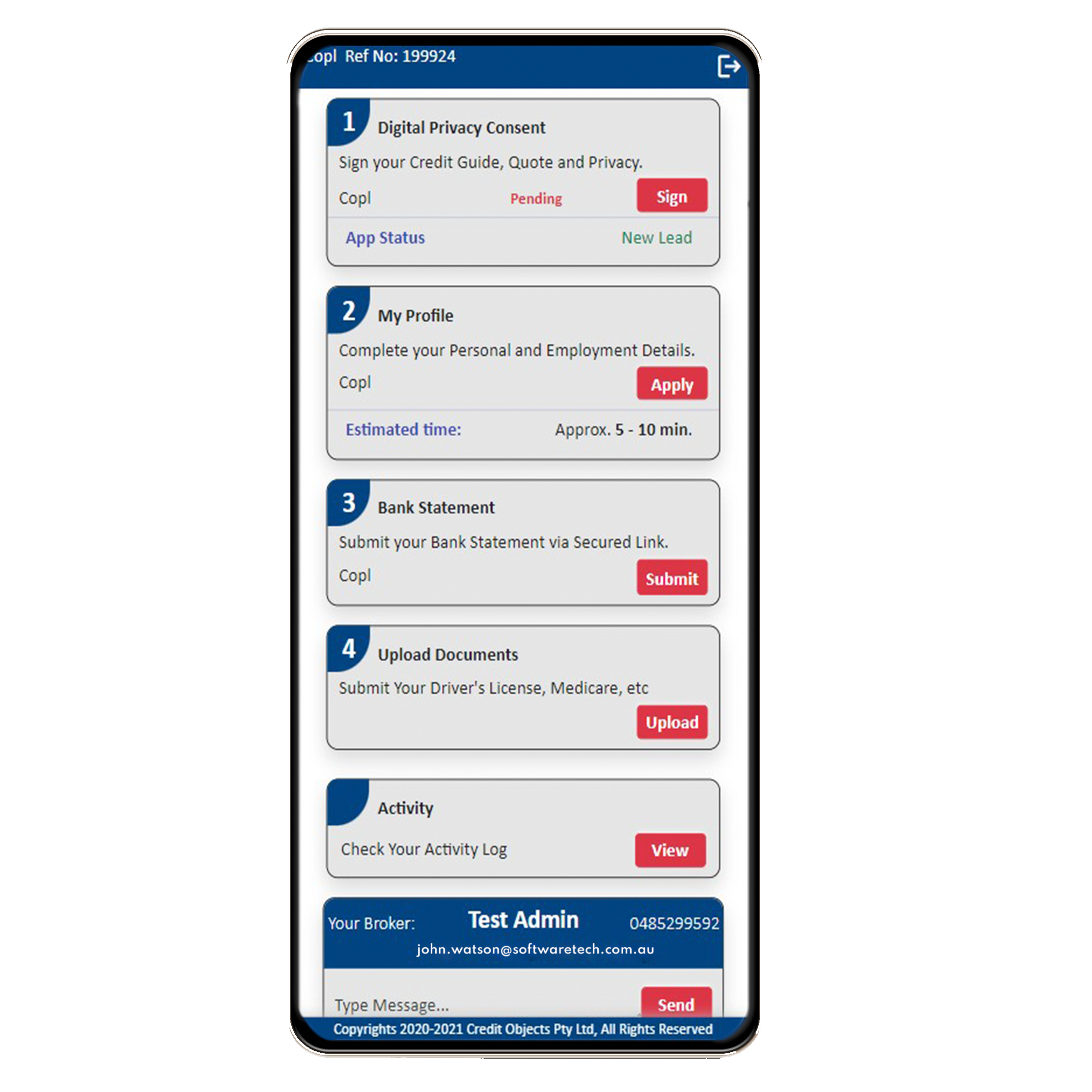

Client Portal is specifically designed for Customers to complete digital privacy, submit bank statement and supporting documents to submit their loan application. Customers can also track their progress via Activity Log and can contact the assigned broker in case of any assistance required in completion of their loan application. Client Portal is easily accessible over smartphones and has a very user-friendly interface. It allows customers to complete all the requirements and submit their loan application at their convenience.

Credit Objects PTY LTD @ 2021. All Rights Reserved

We will get back at you as soon as possible